Navigating the 2021 regulatory landscape

Industry -

Life insurance in superannuation provides an accessible and cost-effective way for Australians to protect themselves and their loved ones in the event of sickness and injury. It can also provide peace of mind and confidence for the future, particularly when they may not otherwise be able to access cover.

Last year TAL paid $1.4 billion in claims to superannuation fund members and their families. Industry wide, it's estimated that 84 cents in every dollar of premiums is being returned to members1 . Although this illustrates that insurance in super has been an efficient delivery mechanism for life insurance, more can be done to ensure quality outcomes that are valued by members.

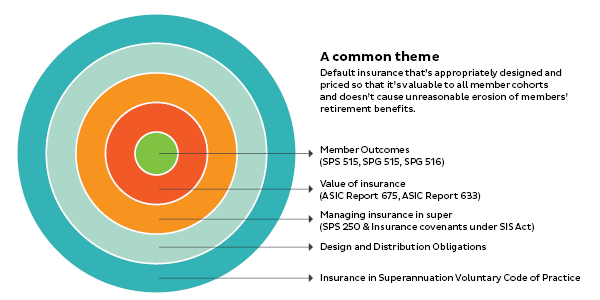

Our industry has experienced greater scrutiny and significant change in recent years, from the impact of the Royal Commission, to the implementation of significant legislative changes for Protecting Your Super (PYS) and Putting Members’ Interests First (PMIF). TAL supports the objective of government and regulators in making sure life insurance is appropriately designed and priced so it provides value for all members.

Current and emerging trends we’re seeing

The common themes emerging from this recent and planned legislative and regulatory activity are the increasing the value of insurance for members, encouraging mergers when this strategy is in the member’s best interest, and increasing members’ choice.

Momentum is also growing for a government-backed inquiry into the sustainability of insurance in superannuation. Federal Finance Minister Jane Hume suggested recently that a governmental inquiry into insurance within superannuation was “worth consideration” and there’s a suggestion that there will be further focus on total and permanent disability insurance.

Other current and emerging trends in the industry include:

- A drive towards personalisation to meet members’ insurance needs with default cover forming an affordable base.

- Improving the value of default cover by reducing the number of restrictions to cover, for example TPD definitions available to more members (see ASIC’s reports 633 and 675).

- Increasing scrutiny from regulatory bodies, including the establishment of enforceable codes of practice for life insurers and trustees of superannuation funds.

- An ongoing focus to support the accumulation of retirement savings by better aligning insurance to the needs of members. For example, delaying the commencement of default cover until a member turns 25 years of age and has an account balance of at least $6,000, and reducing the number of inactive accounts.

- Designing member-centric insurance products consistent with industry standards enshrined in the Insurance in Superannuation Voluntary Code of Practice and the Design and Distribution Obligations.

Greater obligations for funds

The year ahead promises further regulatory change for insurance in superannuation. Our ambition is to partner with superannuation funds to ensure members understand life insurance and provide them with choice, while ensuring it doesn’t cause unreasonable erosion of their retirement benefits.

Some obligations that will be on your radar include:

- The Treasury Laws Amendment (Your Future, Your Super) Bill 2021 amending the Superannuation Guarantee (Administration) Act 1992 and Superannuation Industry (Supervision) Act 1993 to reduce the number of superannuation accounts and ensure investment performance outcomes for members

- The proposed changes to SPS 250 including a fairer attribution of occupation ratings to members, affordable and member centric design

- The annual outcomes assessment and business performance test enshrined in SPS 515 and SPG 516 focusing on member outcomes and performance maximisation

- The RG 274 product design and distribution obligations promoting products that members value.

How TAL can help with your regulatory compliance

We understand that keeping on top of requirements and deadlines may require additional support and resources from TAL, which is why we are creating a new Regulatory Hub on Group HQ where we’ll upload useful material and resources, such as the recent Regulatory Insights note on SPS 250. The next TAL Partner Forum in June will focus on regulation, and will feature presentations and interactive discussion around the important legislative changes facing your fund and members.

We’ll also be developing a series of compliance checklists and other health checks that specifically address regulatory and legislative requirements including those in SPS 515, ASIC’s REP 675 Default insurance in superannuation: Member value for money and the Design and Distribution Obligations outlined in ASIC's RG 274.

Other activities our team are working on this year include:

- Individual partner consultation and advice

- Regular regulatory insights collateral and communications delivered via your Client Manager

- Peak body and Treasury advocacy, consultations and submissions.

For further information on how TAL can assist with your regulatory compliance, please speak to your Client Manager.

1 APRA Life insurance claims and disputes statistics: https://www.apra.gov.au/publications/life-insurance-claims-and-disputes-statistics