Two key areas that can improve insurance in superannuation

A landmark new report has highlighted the significant benefits insurance in superannuation provides to members and to the Australian community, while pointing the way forward for the system.

The Future of insurance through superannuation report by Deloitte Access Economics was commissioned by the Association of Superannuation Funds of Australia (ASFA), with input from ASFA trustee and insurer members, including TAL. The report captures the social and economic benefits insurance in superannuation brings to Australian households and the broader community and also looks at policy options to make the system even better.

TAL welcomes the research and findings of the report and we’re supportive of communicating these benefits to policy makers who help shape the future of the industry.

Insurance in superannuation creates value for members

The report’s analysis of the latest data on insurance in superannuation for 2021 found significant benefits for members and the wider community:

- More than $6 billion in death, total and permanent disability (TPD), and income protection (IP) benefits was paid. Almost 50,000 new claims were made by members and their families through insurance in superannuation.

- These members, who might not otherwise have cover, had an average sum insured for both life and TPD of around $136,000 and $4,000 per month for IP.

- The likelihood of a claim being accepted is high – between 89% and 98%, depending on the claim type.

At the broader community level, the inclusive nature of insurance in superannuation fulfils an important role - bringing cover to people who might not otherwise be able to qualify due to their medical history or occupation. It also helps to alleviate the level of underinsurance in Australia. Even with insurance in superannuation, under-insurance across death and TPD alone is estimated to cost the Australian Government more than $600 million per annum in additional social security.

Reforms to strengthen the system

There were two areas of reform identified that could make Australia’s insurance in superannuation system even more effective:

1. Strengthening through better use of data

Group insurance provides a cost-effective way of providing cover; however, the default level only matches the “average” member. While this member is suitably insured, those with more or less needs than the average member could benefit if cover was optimised to their requirements.

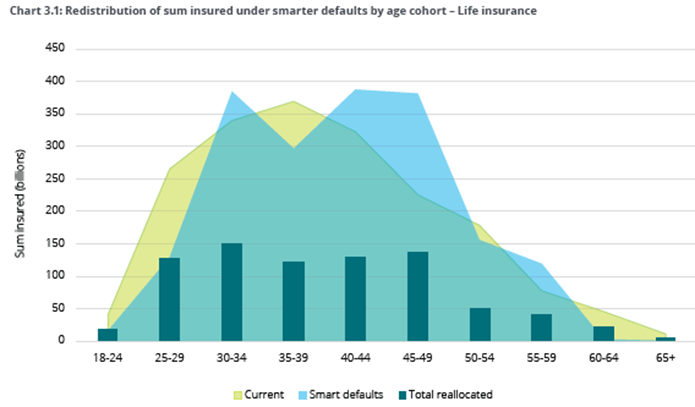

Giving trustees and insurers access to better data would allow them to better target benefits, such as the mix of disability and death cover or whether IP should be offered as a default cover, without losing the benefits of group insurance. Utilising existing data points such as age, marital/de facto status, income, and the number and age of children would support better and more appropriate design. As an example, a possible reallocation of life insurance sum insured by age cohorts is presented in the chart below taken from the report.

Source: The future of insurance through superannuation - Association of Superannuation Funds of Australia (2022), Deloitte Access Economics.

The green shaded area shows the current distribution of sum insured, while the blue shaded area represents the new distribution with income and spouse dependents considered.

Collecting and maintaining data is not simple, but one option could be to utilise existing employer reporting requirements such as SuperStream and Single Touch Payroll. Opening up access to data held by Government agencies such as the ATO is another idea worth further exploration.

2. A greater focus on wellness and return to work

Currently life insurers aren’t allowed to fund the medical treatment that would help members on IP claims return to health and work. The report found that if insurers were permitted to fund relevant treatments it would boost return to work outcomes, with 11% of IP claimants who access rehabilitation treatment and services likely to return to work where they otherwise would not have. Amongst people who would have returned to work anyway, access to treatment is estimated to result in them doing so on average five weeks earlier. Smaller benefits also exist for TPD.

The economic impacts of this policy reform would be significant. Over a 40-year period (equal to the average length of a person’s working life), broader access to treatment could assist an estimated 29,300 members return to work. This would yield an additional 4,400 full-time equivalent workers to the Australian economy by 2062, boosting GDP by around $1.1 billion in that year. At the same time a further $126 million in social and other costs of unemployment would be saved.

If access to treatment could be achieved earlier in a member’s injury or illness – before members make a claim – the benefits would be even greater. An early intervention model would yield an estimated 7,800 extra full-time equivalent workers by 2062, delivering $1.9 billion in additional GDP in 40 years’ time. Social and other costs would be reduced by $224 million.

There are still obstacles to life insurers funding medical treatment in both superannuation and health legislation. ASFA and its members, including TAL, will engage with government to explore its appetite to address these constraints.

Get into touch to learn more

If you would like further information or would like to discuss any of the findings raised in The future of insurance in superannuation report, please speak to your Client Manager.